Anchor

A decentralized crypto savings account

👋 Welcome to the thirteenth issue of The Syllabus from Invisible College – a weekly newsletter that will help you navigate the complex world of web3. To get this newsletter delivered to your inbox, subscribe here:

Before we begin, a disclaimer – nothing here is financial advice. We’re analyzing projects that we find interesting in the hope that you’ll enjoy learning about them as well. With that, let’s dive in.

Most big banks offer savings accounts with a measly 0.01% APR. Even robo-investment companies like Wealthfront only offer 0.35%. With inflation rates at their highest in 40 years, investing your money into a savings account effectively means that you’re losing money. Anchor offers another way.

As of this writing, Anchor is offering an annual percentage yield (APY) of 19.42%. But before you immediately deposit your life savings, let’s do some research into how it works.

What is Anchor?

Anchor is a decentralized finance (DeFi) protocol on the Terra blockchain. A DeFi protocol enables investors to transact with each other through code on the blockchain without any intermediaries or humans involved.

Anchor’s goal is to become the largest web3 savings product that’s “safe enough to gain mass adoption.” This is why it’s often described as the premier crypto savings account.

How does it work?

Anchor lets you earn yield on UST, an algorithmic stablecoin that’s pegged to the US dollar. Meaning 1 UST = $1.00. You can then deposit your UST in exchange for the aforementioned 19.42% annual yield.

UST is an integral part of the Terra blockchain. But we can’t talk about UST without also talking about LUNA, the other native token to Terra. You can think of how UST and LUNA are used in Terra similar to how ETH is used in the Ethereum blockchain.

The system algorithmically maintains the stable $1.00 peg for UST via the LUNA token. At any time, 1 UST can be swapped for $1.00 of LUNA (and vice versa), which changes the price of each slightly each time they’re swapped. Arbitrageurs, traders who seek to profit from small price discrepancies, help to keep the UST price stable by expanding and contracting its supply.

LUNA is currently the 9th highest ranked cryptocurrency by market cap and UST is the 14th. But more importantly, UST is the 4th largest stablecoin and it’s growing fast. As more and more people adopt and use UST, the supply of LUNA goes down, which drives up the price of LUNA. This means the Terra ecosystem is incentivized to push for more adoption of UST.

The Terra team has implemented UST acceptance at 20+ e-commerce stores in Korea and inked a deal with the Washington Nationals to eventually accept UST for in-stadium purchases at Nationals Park. And with credit card fees that are upwards of 3%, compared to UST’s 1%, we should see a lot more businesses adding UST acceptance in the future.

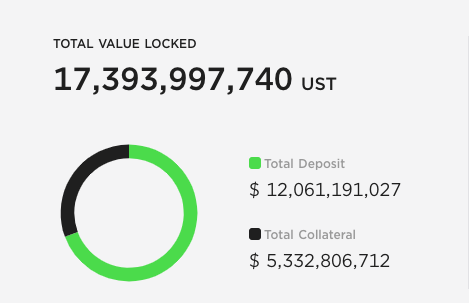

But the largest driver of UST adoption has been Anchor with over $17B in total UST locked in the protocol in the form of savings deposits and borrowing collateral.

How can they offer such a high savings rate?

There are several reasons traditional banks offer such low rates. Interest rates on loans have been low for years now and they like to keep savings rates much lower than lending rates. The biggest banks have also captured a large swath of the market already. By offering 0.01% APR, traditional banks are signaling to the market that they’re not competing as aggressively for your business. On the flipside, Anchor is competing for your business and they need more money deposited. Lots more. So they offer an incentivized rate that is heavily subsidized, most recently by a $500M infusion of capital in February 2022.

Beyond subsidies, Anchor earns income through three primary sources:

1. Borrowing interest

In addition to the UST savings account, Anchor offers collateralized loans for the assets LUNA, ETH, ATOM, and AVAX. Borrowers are currently charged 10.72% APR on the UST they borrow.

The problem is that the savings side of the protocol is growing faster than the borrowing side. This means the amount of interest that can go towards covering the savings rate goes down as a percentage of deposits over time, assuming the adoption of UST keeps growing at a faster clip than borrowing.

2. Collateral staking interest

When people borrow against their assets in Anchor, the protocol holds those assets in the treasury and can stake them to earn returns.

Anchor has historically earned about 9.5% on LUNA staking and 4.6% on ETH staking per year through their partner Lido Finance. Those returns are then sent to the yield reserve to help offset the savings rate.

3. Liquidations

Another term for borrowing against collateral is leverage. When you use leverage, you never want to borrow an amount that’s equal to the entire amount of your collateralized asset. If the price of that asset were to decrease at all, then you would be liquidated, meaning the protocol would start to seize those assets since you’re now unable to pay the loan back in full with the assets you borrowed.

For this reason, protocols typically have an upper limit on leverage. On Anchor, the maximum leverage amount is 60%.

As an example, let’s say you want to leverage $10,000 in ETH and the price of ETH is $3,000. You would go to the “borrow” tab on Anchor and provide $10,000 in bETH collateral in exchange for $6,000 in UST. In the meantime, if the price of ETH were to eventually dip below $1,800 ($3,000 x 60%), then the protocol will start burning some of your collateral to pay back the difference.

When liquidations occur, the protocol sends 1% of the liquidated amount to the yield reserve. This is the third, and smallest, revenue source.

How long can the high APY last?

Since the APY rate is mostly subsidized, it will certainly go down over time. A dynamic rate proposal passed recently, which outlines a steady reduction in the rate by 1.5% per month until equilibrium is reached. It’s impossible to know what the equilibrium rate will be for sure since there are lots of factors that go into it, but many analysts believe it will be somewhere between 7-8% APY – still much higher than your bank offers you.

How safe is it, really?

The biggest risk to Anchor lies in UST. You’d think that maintaining a price of $1.00 would be simple, but it’s quite complex when there aren’t assets fully backing that price on a 1:1 basis. And most algorithmic stablecoins have failed in the past.

Since UST is tied to LUNA, if there’s a lot of volatility in the market, the conversion ratio of UST to LUNA can deviate slightly, causing the price of UST to lose its $1.00 peg. If it loses its peg and doesn’t recover, it could quickly plummet to zero. There have been two instances where it lost its peg in the past, but it was able to recover both times.

Do Kwon, one of the cofounders of Terraform Labs, has also been buying up large sums of Bitcoin to bolster the underlying assets with the goal to solidify UST even more.

If the total value locked in Anchor continues to grow and the Terra team keeps expanding their partnerships, UST will only become more accepted as a payment option in the real world and a more stable asset over time. And stable is the name of the game.

Want to learn more?

Visit the Anchor website to explore more

Read the Anchor whitepaper to dive deeper

Join our DeFi 101 session where we’ll walk you through how to stake UST in Anchor

DeFi 101

Thursday, April 28th, 6:00 PM PT

Decentralized Finance (DeFi) is unlocking new ways for ordinary people to put their money to work.

In this free 1-hour crash course, Invisible College faculty member, Rockwell Shah will share:

How DeFi works

What you can do with DeFi

Low-risk ways you can earn a higher yield on your money

At the end of the session, we'll even walk you through how you can stake on Anchor and earn a 19.42% APY on stablecoins.

This event is open to the public. To join, register here.

Other projects we’re exploring

Moonbirds – An NFT project from the Proof Collective, a group headed up by the veteran founder and investor Kevin Rose.

Superlocal – A social network that lets you earn crypto and NFTs when you check into places.

The Possessed – An upcoming NFT project which will include a fully animated character with 2 static PFPs, one of each state (Blessed and Possessed).

Invisible College Recommended Reads

Strategies for Low Budget Crypto Portfolios | 5-minute read

Practical advice for how best to invest your money in crypto when you have a smaller budget.Infinite Regret | 14-minute read

A post about dealing with regret in a market with infinite opportunity.The Blockchain Man | 25-minute read

Taylor Pearson contrasts the classical literary trope of The Organization Man with an emerging idea of what a modern man might look like in a crypto-centric future.

Community Updates

Decentraliens

A lot has happened with our NFT collection recently, so let’s jump right into the updates:

Official Decentraliens rarity on HowRare.is – You can now check the rarity of your Decentralien on the HowRare.is website. Keep in mind that rarity is only one component when it comes to determining the value of your Decentralien. Decentraliens get equal access to Invisible College, regardless of rarity.

Decentraliens sent to contest winners and pre-mint contributors – If you were a lucky contest winner or if you contributed to Invisible College before the mint, check your wallet!

All metadata mismatches resolved – Any Decentralien holders who minted an NFT with mismatched metadata have been airdropped new tokens with matching metadata. Please note that the mismatched NFTs can’t be sold. If you would like to burn yours, let us know in the Discord and we’ll give you the burn address.

Token-gating – The Invisible College Discord community and content library will be token-gated by the end of the month. Meaning you will need to own a Decentralien NFT in order to access most of our live events and the library of recordings. Get your Decentralien on Magic Eden.

Advisory Councils

The Invisible College community is full of people with superpowers and we are ready to activate them. These advisory councils are designed to be a light-commitment way for members to build relationships and advise Invisible College on some of our key initiatives.

We plan to launch a number of advisory councils in the coming weeks and months. Here are the first ones we are staffing up:

Merchandise

Help Invisible College build an amazing online store for Decentralien merch.

Ecosystem Partnerships

Connect Invisible College with other communities, people, and companies to enable us to provide discounts & special opportunities to the IC community.

Corporate Training

Help us build connections with companies that want web3 training and advise us on building an effective corporate training business line.

If you believe you’d be a great fit for one of these advisory councils, fill out this form:

Upcoming Events

Here are the events we’re hosting at Invisible College this week:

Tokenomics Office Hours w/ Rockwell Shah

Mon (4/18) @ 3 pm PT (Discord)

Join faculty member Rockwell Shah in The Quad to ask questions and talk about what's going on in web3.Dating in the Metaverse

Wed (4/20) @ 12 pm PT (Discord)

NFTs are a powerful mechanism for building community. We’ll talk with Chad Goodman from Teleport Social Club about how they might also help kindle romantic relationships.The State of the Macro Crypto Market

Thurs (4/21) @ 12 pm PT (Discord)

The daily swings of the market can make you lose sight of the long-term. Bryce Gilleland from Asha Capital Partners will guide us through current trends and where he sees the market heading.Town Hall

Fri (4/22) @ 12 pm PT (Discord)

Join us to hear the latest updates about what’s going on at Invisible College.

Want to get all the Invisible College events on your Google calendar? Just click this link to subscribe to our events calendar.

Invisible College, is a learning DAO that helps people learn to build and invest in web3 projects. To access our courses, events, and learning community, you’ll need to hold at least one Decentralien. You can get yours on Magic Eden.