👋 Welcome to the 34th issue of The Syllabus from Invisible College — a weekly newsletter that helps you navigate the fast-moving world of web3. To get this newsletter delivered to your inbox, subscribe here:

Invisible College Info

Access NFT Benefits – If you’re a Decentralien holder, you can connect your Solana wallet and check out all the courses and recorded events available to you here.

Become a Member – If you’d like to join Invisible College and access our courses, live events, and token-gated community, learn how to become a member here.

Upcoming Events – We’ve got a packed schedule of web3 learning events coming up. You can check them all out and RSVP here.

Now onto this week’s post…

Crypto investors have a tendency to fall for the same type of scam over and over again.

Here’s how it works:

Imagine you buy into a new DeFi protocol called NumbaGoUp. At the current APY, if you buy $100 of the $NGU token, you’ll get a payout of $2 per day.

You think, “Great! I’m going to break even in 50 days and then the rest is profit. I’m a genius.”

A few days go by. You’re steadily making your $2 per day. You’re super excited. The plan is working! So you tell everyone around you about this magical money you’re making. Other people hop on board because they don’t want to miss you. YouTube and TikTok influencers start to post videos about this opportunity to make “life-changing” money.

Your original asset appreciates. Now $NGU is worth $200. Your “passive income” has also gone up to $3 per day. Wow, you really are a genius. You make a spreadsheet and calculate how much you’ll make in three months, six months, a year. You’re going to make SO MUCH MONEY!!!

You keep telling more people. And why wouldn’t you? It’s practically printing money. Twitter threads are written. The hype continues to build.

Some time passes. And then the first cracks start to appear.

“Why is this thing worth $150 now? Why am I only making $2 in passive income again?” you think. “Well, crypto is volatile, I’m still up. It’s not a problem.”

A few more days pass.

“OH MY GOD, WHY IS IT STILL DROPPING?”! Am I okay? Yeah, I’m okay. It’s fine. I’m going to break even soon and everything will be gravy. I just have to be patient. I just need to think more long-term. Err, wait, why is my breakeven point now 90 days away?”

$NGU keeps dropping in price. Your “passive income” becomes smaller and smaller. You get scared that you’re going to end up with nothing. So you sell.

You look back and realize you only ended up making back $50. You lost money. You beat yourself up about it. You think, “Why didn’t I just sell when I was up?!?!”

Does this all sound familiar? It’s okay, you’re not alone. It happens all the time, even outside of web3. In web3, it’s called different things in different contexts: the node model, play-to-earn, move-to-earn, rebase tokens, (some types of) yield farming, NFT trading. It’s the same basic scam over and over again with a different skin.

Of course, in hindsight, it’s absurd. If someone came to you and said, “Give me $100 today and I will give you $50 back later,” you’d tell them to take a hike.

There’s a simple way you can avoid getting into the same situation again.

Know what you’re getting into (and when to get out)

How do sophisticated traders use this pattern to their advantage? After all, someone is making money on these things.

They ask themselves this simple question: “Where does the money come from?”

More often than not, the answer can be boiled down to this: the money comes from more and more people buying into the project.

That should sound familiar by now since it’s literally the definition of a ponzi scheme.

Smart investors are hyper-aware of this and will bolt at the slightest sign of the ponzi unraveling.

During our fireside chat with Jason Hitchcock earlier this year, he described how he moved from protocol to protocol during DeFi Summer in 2020:

“It was like the bridge behind me was burning as I was running with the golden idol that I stole from the temple and things kept on imploding behind me.”

At one point, he was one of the top wallets in the Wonderland project until he sold a month or so before it imploded. He said that something didn’t feel quite right about it:

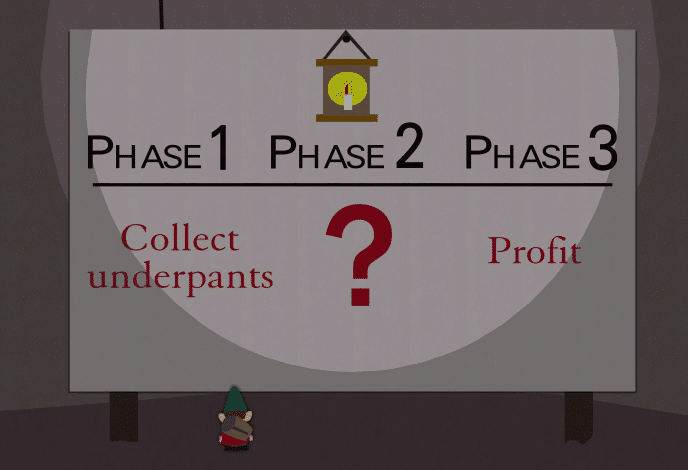

“I was like, oh my God, I just 6x’d very quickly. Let's think about this project for a moment. Yes, Danny is a charismatic founder. They're shipping a lot. He's communicating a lot. There's a passionate fandom. I liked that. Then it was very much like that South Park underpants gnomes episode where it's like steal underpants dot, dot, dot, profit. For Wonderland, what's the dot, dot, dot?”

This doesn’t necessarily mean you can’t trade these ponzi schemes profitably. It’s certainly riskier than simply holding onto a more established asset like BTC or ETH for the long term, but it can generate outsized returns if you know what you’re doing.

When we chatted with OnChainWizard, he gave us this rule of thumb he used to run up $5,000 to over $1M:

Of course, since the wider market downturn, many of these traders have gotten wrecked. The wildly profitable ponzi schemes they made a killing on have been hard to come by in crypto lately. But there will be a day when the markets turn around and you can guarantee you’ll see this same pattern over and over again.

When that day comes and you’re considering a project, spend some time breaking down the fundamental incentives of what you’re buying into or holding onto is key. If something feels off or too good to be true, then it probably is.

Disclaimer: Nothing in this piece should be construed as financial advice.

Other Recommended Reads and Listens

The State of Web3 in 2022 through Data

VC Tomasz Tunguz shares interesting insights mined from on-chain data that he shared at the recent Dune ConferenceThe Next Big Crypto Narrative

Matti from Wrong A Lot writes about how crypto needs to find new narratives that take into account basic fundamentalsThe Psychology of Crypto

Author Morgan Housel joins the Bankless podcast to talk about how lessons from his best-selling book “The Psychology of Money” apply to crypto

Invisible College, is a school that helps people learn to build and invest in web3. To access our courses, events, and learning community, you’ll need to hold at least one Decentralien. You can get yours on Magic Eden.

If you enjoyed this post, please let us know by giving the heart button below a tap.