Why Blockchains are Digital Countries

And cryptocurrencies aren’t what you think they are

👋 Welcome to the 27th issue of The Syllabus from Invisible College — a weekly newsletter that helps you navigate the fast-moving world of web3. To get this newsletter delivered to your inbox, subscribe here:

Before we begin, a disclaimer — nothing in this piece should be construed as financial advice. With that, let’s dive in.

Upcoming Events

We’ve got a packed event calendar over the next two weeks. Here’s what’s coming up:

How Web3 Can Unlock Learning (Thurs. 7/28 @ 3 pm PT)

Town Hall (Fri. 7/29 @ 9 am PT)*

Office Hours w/ Rockwell Shah (Mon. 8/1 @ 1 pm PT)*

NFTuesday (Tues. 8/2 @ 3 pm PT)*

No-Code Product Demo w/ Rampp (Wed. 8/3 @ 9 am PT)*

The Importance of Digital Property Rights (Thurs. 8/4 @ 12 pm PT)*

*To access these events, you’ll need to hold at least one Decentralien NFT.

Now onto this week’s post…

Picture a crypto trader in your mind.

You’re probably imagining someone staring at a computer monitor—or maybe multiple monitors—with squiggly lines and green and red bars on a graph, their hand on their mouse, ready to pounce on the next profitable buying or selling opportunity. This person is up on all the latest news, with CNBC playing on a TV in the background and countless articles pulled up in countless browser tabs. They’re looking for every bit of edge they can get.

What they probably don’t realize is that they are investing in digital nations.

Native assets for layer 1 blockchains such as Bitcoin, Ethereum, and Solana are often compared to other financial assets like stocks in companies. But those blockchains should be evaluated like countries instead.

Origin stories

Every country has an origin story. For America, it boiled down to the populist rallying cry, “no taxation without representation.”

For blockchains, Satoshi was the first pilgrim who ventured out to form a new country called Bitcoin.

The Bitcoin nation was born out of dissatisfaction with monetary policy and how the global financial system was being operated. As stated in the original whitepaper, it was a reaction to “the inherent weaknesses of the trust-based model” that internet-based commerce relied upon through global financial institutions. These institutions served as trusted third parties to process electronic payments, whereas Bitcoin doesn’t require trust and has no centralized issuer or controller.

Then along came another pilgrim, Vitalik Buterin, the founder of the country of Ethereum.

Ethereum was created as an evolution of the Bitcoin experiment. It was less about the financial aspects of a digital currency and more about its underlying technology. Ethereum’s built-in programming language allows users to create decentralized applications “simply by writing up the logic in a few lines of code.” This has led to the wide range of applications across DeFi, NFTs, and more that we see today.

And other blockchains have been built to address problems they’ve found with the Ethereum blockchain. For example, Solana is all about transaction throughput and scalability, in order to attract a more mainstream audience who is less concerned with decentralization.

Why blockchains are digital countries

As you enter the bazaar, you see a vendor selling high-end art, a mom-and-pop shop hawking their wares, and a scam artist pitching items from an obviously fake knock-off brand. But you’re not in a physical marketplace, you’re on Opensea shopping for NFTs—the means by which culture is expressed in the country of Ethereum.

Before you can place a bid on the exact piece of generative art NFT you covet, you need to swap your ETH for WETH, because that’s the required currency for bids on OpenSea. You head over to the banking district known as DeFi, walk into the Uniswap branch, and connect your wallet to confirm your digital identity. When you make the swap, you pay sales tax in the form of gas fees.

You notice there’s a fun game over in the entertainment center in the country of Solana. In order to play, you’ll need to do some foreign trade—i.e. bridge your assets—and exchange your ETH for SOL using DeFi in the Solana ecosystem.

You get the point. For some more extensive examples, check out Rockwell’s tweet thread:

As you spend more time in these digital countries, you’ll notice just how empty they are right now. This is partially due to the current bear market, but it’s also because none of the use cases have scaled well as of yet. Some of the larger NFT brands are attempting to go mainstream and a few games have come close, but neither of them have quite pulled it off.

There aren’t many builders either. It’s hard to get the exact number of active web3 developers, but most estimates come in well under 50,000. For comparison, Google alone has just under 30,000 developers.

The proliferation of new blockchains such as Algorand, Elrond, and others is reminiscent of the ghost cities in China that were built up in expectation of future growth. Many blockchains will suffer a similar fate if they can’t build a compelling reason for people to engage in commerce there. Yet even “dead” blockchains still retain some value. Terra Classic still has a market cap of over $600M despite causing one of the largest wealth-destroying events in crypto history.

Cryptocurrencies are not what you think they are

There’s a common question you’ll hear from crypto skeptics: “When will I be able to use it to buy something in the real world?” But the question doesn’t really make sense.

In the United States, you wouldn’t use Euros to buy your Starbucks coffee. Similarly, you shouldn’t expect to use Bitcoin to buy it either—and not only because of its price volatility. Sure, we might eventually see a stablecoin gain mass market adoption and get implemented into real-world point-of-sale systems, but that’s a long way off.

A cryptocurrency is simply the native asset of that digital country.

How should you value cryptocurrencies?

Getting back to our crypto trader from the beginning. How should they value the currencies they’re trading?

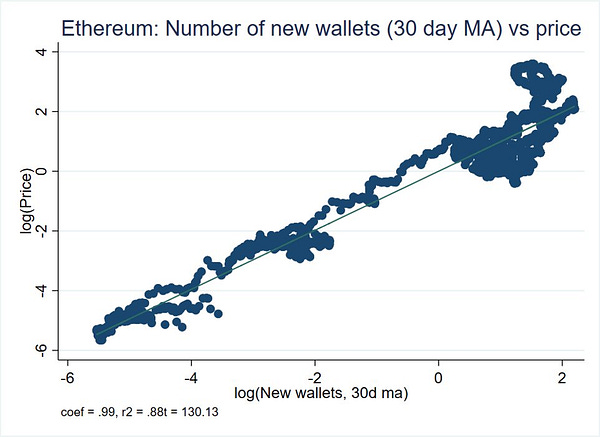

To help us understand the price movement of the native asset to the country of Ethereum, we’ll turn to a section of this excellent thread from the macroeconomist Tascha.

ETH price movements are highly correlated to these three metrics:

Transaction volume growth:

Increase or decrease in the growth of total wallets:

The acceleration or deceleration of wallet growth:

While the high-level wallet data is readily available to download from Etherscan here, it’s not exactly easy to put this sort of analysis together. The ETH merge that’s rumored to be coming up in September introduces other factors that will likely impact price, as well. Post-merge, ETH will become a deflationary asset, which should theoretically create upward pricing pressure.

The important takeaway to remember is that these assets should be viewed with a much different lens than equities. Day-trading is incredibly difficult to do profitably for equities, let alone crypto. Only a small percentage of people do it well. Most will lose.

Instead of day-trading, it’s a better time to learn and build. The pioneers are laying down the foundation right now—they’re the ones who believe in the manifest destiny of the digital countries they live and work in. And if they stick around to build the future, they’ll reap the rewards if and when the masses follow.

Other Recommended Reads and Listens

What are NFTs?

Daniel Tenner (a.k.a. swombat) uses an apt metaphor to explain what NFTs are and how powerful they can beThe Crypto Revolution Wants to Reimagine Books

Elle Griffin breaks down how some startups and writers are trying to upend how authors make a living and how we define who owns a storyThe Future of the Bitcoin Energy Debate

Troy Cross argues that Bitcoin can help usher in a more renewable energy mix in this nuanced discussion on The Breakdown podcast

Invisible College, is a school that helps people learn to build and invest in web3. To access our courses, events, and learning community, you’ll need to hold at least one Decentralien. You can get yours on Magic Eden.